Book summary: How to create a mind by Ray Kurzweil

The book is an insightful journey into the contemporary understanding of the human brain and how scientists are trying to replicate it. Major takeaways from the book are listed below.

The book is an insightful journey into the contemporary understanding of the human brain and how scientists are trying to replicate it. Major takeaways from the book are listed below.

In 2013, we saw how internet activists’ snap judgments about the interpretation (or misinterpretation?) of jokes at pycon destroyed the professional career of two individuals (Source: A Dongle Joke That Spiraled Way Out Of Control). The internet activism first sympathized with Adria Richards and then decided to side with the developer, eventually, both of them (and SendGrid customers temporarily) took a major hit which could probably have been resolved offline and would have never become a part of permanent history. As if this was not enough, this year the same story has been repeated with Gurubaksh Chahal and his girlfriend Juliet Kakish. The claim goes that he allegedly hit his girlfriend 117 times and she allegedly suffered bruises and injuries, there is an alleged video of that proving the same (I haven’t been able to find one yet that does not imply it does not exist though) (Source: A Letter To The Board Members Of RadiumOne).

Enough articles have been written about engineering crunch in the valley while some solutions like increasing equity grants to engineers have been suggested, the bigger issue of the broken recruiting pipeline has not gained the attention it deserves. Its a job of recruiters to source potential candidates and most recruiters are compensated in form of a percentage (usually 20-30%) of the annual base salary of the hired individual.

The book is a humorous compilation of pragmatic lessons which Scott Adams learned while navigating his professional career.

The Art of War is considered one of the classic books on military strategy. Due to the recent resurgence of China as an economic superpower, the book has garnered interest from non-Chinese who are curious to know more about its strategy.

Booting process The bootloader loads the kernel stored in /mach_kernel. Tip: Use rEFIt as a bootloader for dual booting into GNU/Linux. Kernel launches the launchd process which is equivalent of init in GNU/Linux. launchd loads startup processes from several directories (/System/Library/LaunchAgents, /System/Library/LaunchDeamons, /Library/LaunchAgents, /Library/LaunchAgents and corresponding files in ~/Library directory)

I was trying to make some modifications to android emulator and was unable to find good set of instructions for the compiling the same. Here are mine. Bash 1 2 3 4 5 6 7 8 9 10 11 12 13 14 # Get the source code. git clone https://android.googlesource.com/platform/external/qemu cd qemu # Install required dependencies. sudo apt-get install gcc-multilib libesd0-dev libx11-dev \ libxext-dev libasound2-dev libpulse-dev \ lib32stdc++-4.8-dev # Install ia32 libraries (missing from default ubuntu 13.10). sudo apt-get install libgtk2.0-0:i386 libpangox-1.0-0:i386 \ libpangoxft-1.0-0:i386 libidn11:i386 libglu1-mesa:i386 # Configure and build the emulator binary. ./android-configure.sh --no-gles --no-tests --cc=/usr/bin/gcc make -j16 # The emulator binaries are in objs directory.

In Feb 2014, WSJ is reporting that Nokia is working on an Android phone. In Sept 2010, Anssi Vanjoki, outgoing head of Nokia’s smartphone division, likens mobile phone makers that adopt Google’s software to Finnish boys who “pee in their pants” for warmth in the winter. Temporary relief is followed by an even worse predicament. [ source] As someone who has advocated Android for Nokia in the past, I think its just too late now to do that.

As the title suggests, I was looking for a way to send HTML mails in python using Amazon SES but did not find anything (or maybe my search skills are bad). So, once I found the solution, I thought I might share it with everyone. The basic idea is that contents of the mail (raw-message) must be a JSON dictionary with “Data” as main key whose value is a key value pair containing entries with keys like “From”, “To” etc. Sample code can be seen below.

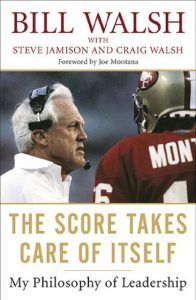

The book is written by Bill Walsh - San Francisco’s 49ers Football team coach who transformed the worst-performing team of its era into the best-performing team. The book talks about the changes he brought in as well as his philosophy of leadership which is generic enough to apply outside of American Football. He is also known as the creator of the West Coast Offense.